How Big Pharma Wrings More Profits from Opioid Addicts

Every crisis provides an opportunity, as the saying goes.

Big Pharma, always angling for the next blockbuster drug, is making the most of the opioid crisis. The industry is introducing new drugs—and raising the price on older generics—that treat the effects of opioid addiction. In this way it can reap additional profits from the opioid epidemic that it helped to create.

While America wrestles with the worst drug crisis in its history, Big Pharma eyes even bigger profits.

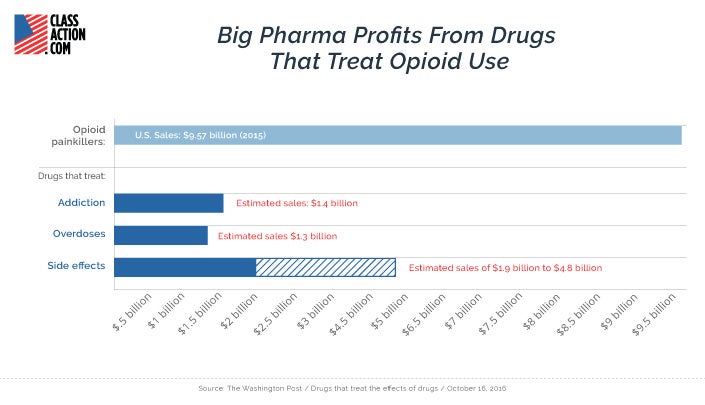

The U.S. opioid painkiller market is worth an estimated $10 billion per year. The emerging market for drugs that treat opioid side effects, addiction, and overdose is already worth half that much. And it is poised for major growth in the years ahead.

It should come as no surprise that drug companies put profits before the public welfare. But Big Pharma’s attempts to capitalize on the worst drug crisis in U.S. history shows how nothing is off limits for the industry in its quest to create top-selling medications.

Drugs That Treat Opioid Side Effects

One of the most controversial moments of Super Bowl 50 did not occur on the field, but during an advertising spot.

The black and white ad—sponsored by AstraZeneca, Daiichi Sankyo, the U.S. Pain Foundation, and others—showed a forlorn man reacting to visual reminders of his constipation while a narrator intoned, “If you need an opioid to manage your chronic pain, you may be so constipated it feels like everyone can go… except you.”

Opioid induced constipation (OIC), the narrator explained, is “different, and may need a different approach.”

That approach, according to the commercial, was the use of medication—such as AstraZeneca’s and Daiichi Sankyo’s Movantik—specifically designed to treat OIC.

The Super Bowl ad spurred a backlash (and humorous takes) on social media, with many saying that it normalized opioid use. Vermont Governor Peter Shumlin tweeted that Big Pharma had “no shame” and was trying to “exploit a crisis for profit.”

.@AstraZeneca spent millions to air a Super Bowl ad normalizing long-term opiate use - A shameful attempt to exploit a crisis for profit

— Peter Shumlin (@GovPeterShumlin) February 11, 2016

But the ad was a success: AstraZeneca reported that Movantik prescriptions increased by one-third in the months following the Super Bowl. A single Movantik pill retails for about $10.

Opioid induced constipation reportedly afflicts 40-90 percent of opioid users. Researcher Jonathan Moss came up with an OIC treatment in the late 1990s to help cancer patients taking opioid painkillers. Drug companies, however, were not interested in a product that targeted such a limited patient pool.

As the opioid epidemic spread, drugmakers changed their tune. Now they are scrambling to enter a market that has blockbuster potential.

There's a Pill for That

In 2014, AstraZeneca’s Movantik was the only OIC drug available. Today there are six name brand OIC drugs. By 2019, there could be as many as eight.

The market for OIC drugs in Western Europe and the United States is expected to grow from $67 million in 2016 to more than $650 million by 2019, including $563 million in the U.S. alone. Incredibly, the U.S. has less than 5 percent of the world’s population but consumes 80 percent of all opioids.

The U.S. has less than 5 percent of the world’s population but consumes 80 percent of the world's opioids.

Until recently, doctors advised opioid patients to moderate their painkiller intake or use non-drug interventions such as changes in diet or exercise to treat constipation. Critics say that offering a drug for a condition caused by a drug not only encourages patients to continue using opioids unabated, but also incentivizes further drug use.

“The pharmaceutical industry literally created the [OIC] problem,” Dr. Andrew Kolodny of Physicians for Responsible Opioid Prescribing told the Washington Post. “They named it, and they started advertising what a serious issue it is. And now they’ve got the solution for it.”

Dr. Kolodny explains the vicious cycle of drug use that can trap opioid users as they try to balance out from the side effects of the potent painkillers.

“Many patients wind up very sedated from opioids, and it’s not uncommon to give them amphetamines to make them more alert. But now they can’t sleep, so they get Ambien or Lunesta. The amphetamines also make them anxious, paranoid and sweaty, and that means even more drugs,” he said.

Other common opioid side effects that may require medication include nausea, central nervous system effects (such as cognitive dysfunction and agitation), and pruritus (itch).

Drugs That Treat Opioid Addiction

In 2014 (the most recent year for which data is available), nearly 2 million Americans abused or were dependent on prescription opioids. Even a single opioid prescription can lead to long-term opioid use. As many as 1 in 4 patients who are prescribed opioids struggle with addiction.

Treatment for opioid addiction is critically important due to the risk of overdose deaths. In 2015, more than 15,000 people died from prescription opioid overdoses.

Methadone

Drugs to treat opioid addiction have been around for nearly a century. Methadone—itself an opioid—was first manufactured in the 1930s in Germany as a less-addictive alternative to morphine. Methadone made its way to the States after World War II and was produced by Eli Lilly under the brand name Dolophine.

In the 1950s doctors began using methadone to treat opioid dependence. This trend strengthened in the 1960s as heroin-addicted American soldiers returned from Vietnam. Today, about 500,000 people are participating in methadone treatment programs for opioid addiction.

Since the onset of methadone is mild, it doesn’t produce the euphoria that other opioids do. But it reduces drug cravings and prevents the harsh withdrawal that often triggers an addict’s relapse.

Methadone treatment programs are controversial. Some believe “Just Say No” doesn’t work and that the programs are a pragmatic way to fight addiction. Others claim that replacing one opioid addiction with another doesn’t solve the underlying problem.

Then there is the financial angle. Methadone clinics can cost up to $76 per day per patient. Government-subsidized methadone treatment costs taxpayers more than $1 billion per year. In 2016, the federal government pledged more than a billion dollars to states for medication-assisted opioid dependence treatment (i.e., methadone treatment).

Those who oppose using public funds for medication-assisted treatment say it is unfair and unethical that taxpayers subsidize drug companies and for-profit treatment programs that provide legal opioids to addicts.

Jeff Sessions called the $1.3 billion false billing scam “the largest health care fraud takedown in American history.”

This summer the federal government announced a crackdown on healthcare fraud involving opioid treatment programs. That announcement followed a Justice Department takedown of a $1.3 billion false billing scam that Attorney General Jeff Sessions called “the largest health care fraud takedown in American history.” Of the 412 defendants, 120 were charged with opioid-related crimes.

As investors pour big money into addiction treatment and fraudsters try to cash in on false opioid billing, it would appear that the opioid crisis is providing financial opportunities for more than just drug companies.

(Click below for more.)

Suboxone

Methadone is not the only player in the growing opioid addiction treatment market. As the opioid epidemic deepens, new drugs are vying for a piece of the multibillion-dollar addiction management industry. And as one might expect, this pharmaceutical gold rush has ushered in some unethical behavior.

The most notorious of these drugs is Suboxone. A combination of buprenorphine (an opioid painkiller) and naloxone (a drug that blocks the effects of opioids, meant to deter abuse), Suboxone is the result of a public-private partnership between the American government and the British drug company Reckitt Benckiser.

Suboxone's track record is marred by a subculture of diversion, abuse, and shady doctors prescribing it for profit.

Like methadone, buprenorphine was born in a laboratory as an alternative to morphine. Buprenorphine attracted the interest of government scientists in the United States who were interested in the drug’s potential to treat addiction. They considered it superior to methadone in part because early testing showed low overdose potential.

The National Institute on Drug Abuse (NIDA) spent $28 million to finance clinical trials. In 2002, the U.S. Food and Drug Administration (FDA) approved Suboxone, granting it a seven-year monopoly.

Federal advocates of Suboxone said the drug was “for the public good.” But as the New York Times reports, there were extensive public-private ties between the government and Reckitt Benckiser. For example, a government pharmacist and early Suboxone champion went on to become executive vice president of Reckitt, and the company contracted with the NIDA director who originally promoted the partnership.

Congress changed a federal law that prohibited doctors from prescribing narcotics to narcotic addicts.

Following FDA approval, one final regulatory hurdle had to be cleared. Since Suboxone’s proponents wanted the drug to be prescribed in doctor’s offices (unlike methadone, which patients can only receive at clinics), a federal law that prohibited doctors from prescribing narcotics to narcotic addicts had to be changed. This was done with help from high-ranking members of Congress like Orrin Hatch and Joe Biden.

While Suboxone has had its treatment successes, the drug’s track record is marred by a subculture of diversion, abuse, and unscrupulous doctors prescribing it for profit. It cost Medicaid agencies at least $857 million over a three-year period, the Times reports, and nationwide more than 10 percent of buprenorphine doctors have been sanctioned.

Suboxone has also been implicated in hundreds of overdose deaths.

When Reckitt’s patent for (and monopoly on) Suboxone expired in 2009, Suboxone enjoyed an 85 percent share of the opioid treatment market with annual sales of $2 billion. In 2016, Suboxone generated $1.5 billion in U.S. sales.

Seeking to retain its monopoly, Reckitt did not take kindly to the FDA’s 2013 approval of two generic versions of Suboxone. It tried to protect its franchise in a series of aggressive moves that led to an antitrust lawsuit filed by 35 states and the District of Columbia.

Reckitt developed a new formulation of Suboxone featuring a dissolvable filmstrip with a traceable barcode that Reckitt said would protect against accidental pediatric poisonings and black market diversion. The company then campaigned against pill versions of Suboxone and promoted the Suboxone film.

In 2016, Suboxone generated $1.5 billion in U.S. sales.

Citing safety concerns, Reckitt pulled its own tablets from the market and asked the FDA to do the same for generics. The agency declined.

These actions, the lawsuit against Reckitt claims, sought to game the pharmaceutical regulatory process using “deceptive and unconscionable” practices, “fear-based messaging,” “sham science,” and “product hopping.”

Product hopping refers to the drug company practice of tweaking a product slightly without making substantial improvements, in order to maintain patent protection and market share. ClassAction.com attorney James Young described this process in a recent article. “Manufacturers can get renewed or extended patent protection and stave off generic competition by creating a new product called a combination product,” Young wrote.

Reckitt’s antics have led several states to replace Suboxone with competitor Zubslov (a slightly different combination of buprenorphine-naloxone) as the preferred drug for opioid addiction treatment.

Another competitor, Vivitrol (naltrexone), which sells for $1,300 per shot, generated $55.8 million in sales for maker Alkermes in the first three quarters of 2016. Alkermes is eyeing Vivitrol sales of $700-$800 million by 2018.

Drugs That Treat Opioid Overdoses

Naloxone is a frontline weapon in the war against opioid abuse. The drug is an “opioid antagonist” that instantly reverses dangerous side effects and brings a user back from the brink of a fatal overdose.

Available since 1971, naloxone not long ago cost around one dollar per dose. But as demand for the drug has risen, drug companies have increased prices by 1,000 percent or more. Naloxone sales increased from $21.3 million in 2011 to $81.9 million in 2015.

As demand for naloxone has risen, drug companies have increased prices by more than 1,000 percent.

The drug company Hospira was the sole producer of injectable naloxone in 2008. That same year, just as the opioid crisis was accelerating, Hospira increased the price of naloxone by 1,100 percent.

In 2005 a dose of Hospira’s injectable naloxone cost $0.92. The price went up to $21.90 in January 2014. Pfizer bought Hospira in 2015.

Adding competitors to the naloxone market did not lower prices. In 2014, Kaleo Pharma introduced Evzio—an auto-injector designed for people with no medical training—at a price of $690 for a package of two. By February 2016, an Evzio package cost $4,500.

Amphastar Pharmaceuticals, maker of an injectable form of naloxone, increased costs from $19 per dose in June 2014 to $41 per dose in January 2015.

Naloxone price hikes have caused some emergency response departments to run out of the lifesaving drug.

Adapt Pharma’s Narcan, a nasal-spray form of naloxone, cost $150 for a two-pack in 2016. Mylan’s injectable naloxone cost $23.72 per vial in 2016.

Naloxone price hikes have caused some emergency response departments to run out of the lifesaving drug. They have also made it hard to obtain for community organizations that provide free naloxone to the community.

A growing number of communities require first responders to carry naloxone. Earlier this year, New Mexico became the first state to require all local and state law enforcement agencies to carry the drug.

While a limited number of suppliers has contributed to higher prices, many think that Big Pharma is intentionally raising prices in response to higher demand. The New England Journal of Medicine says that naloxone’s price increase is part of a larger trend of rising drug prices.

“We’re not talking about a limited commodity. Naloxone is a medicine that is almost as cheap as sterile sodium chloride—salt water,” said Dan Bigg of the Chicago Recovery Alliance.

Senators Claire McCaskill and Susan Collins of the Senate Special Committee on Aging sent a letter to the five naloxone-producing drug companies, asking them “what actions [they] are taking to ensure continued and improved access to naloxone, an explanation for price changes in [their] company’s naloxone product, and a description of the available resources and tools to prevent barriers to access and shortages of this critical and life-saving medication.”

Drug companies counter that they offer special pricing and donate naloxone to first responders, public-health departments, and nonprofits.

But with overdose deaths now surpassing traffic deaths in America, relying on the generosity of drug companies isn’t an ideal long-term solution. Demand for naloxone will not decrease any time soon. Without government action, more naloxone price hikes seem inevitable.

Pharmaceutical companies have proven, after all, that they are opportunistic if nothing else.